‘Life either a daring adventure or nothing at all,’ betting is the favorite activity of human beings. It does not matter whether you win or lose, we keep betting on our instincts. Augur is a decentralized peer-to-peer gambling platform where two people can enter into a betting agreement or contract with one another. It is built on top of Ethereum. One of the advantages of using Ethereum to build such applications is that it completely removes the involvement of a middleman. There is no central owner of it and no business that operates its contract. Augur allows participants to place bets virtually on anything. The bet can be placed on who will win a cricket match or elections. The system rewards for correctly predicting the outcome of future events. You lose your money if the guess goes wrong. Remember Augur itself is not a prediction market. Rather it is the protocol for developers who wish to create their own markets.

A better can speculate on anything. It may be elections, sports, stock, commodities, etc. All markets are created by users. No single entity has the authority to govern or create a market. The smart contract is built on Ethereum. These contracts allow to create any sort of prediction marketplace. One earns trading fees from creating a market. Oracles are built in a way to tell the truth for a given forecast. Augur has people reporting on the outcomes of the events. The report is weighted by a thing called Reputation. People who report are rewarded with trading fees in the market.

Get started with Augur

The system rewards the participant for each time correctly predicting the outcome of future events. The first step to start with Augur is to download the augur app and connect to Augur mainnet. After connecting, the system begins processing all the previous blocks of the blockchain. Augur allows buying and selling shares in the outcome of an event. The currency market price of the share is an estimate of the current probability of an event occurring. The prices of each share add up to one dollar.

REPUTATION (REP): Native token

The problem with traditional forecast markets is that they are centralized making them easily shut down. In any prediction market, someone has to report what actually happened after the event occurred. In the centralized market, this responsibility is levied on a single person. This may lead to mistakes, manipulation, and corruption. Reputation (REP) token is the traceable token associated with Augur. Augur has thousands of users reporting the outcomes of the event using something called Reputation (REP). You need a reputation token in order to participate in this platform. It is demanded and valuable. Augur launched its v2 version for its non- native cryptocurrency such as DAI users on July 28th, 2020. This extended the scope of betting to non- REP users on the platform.

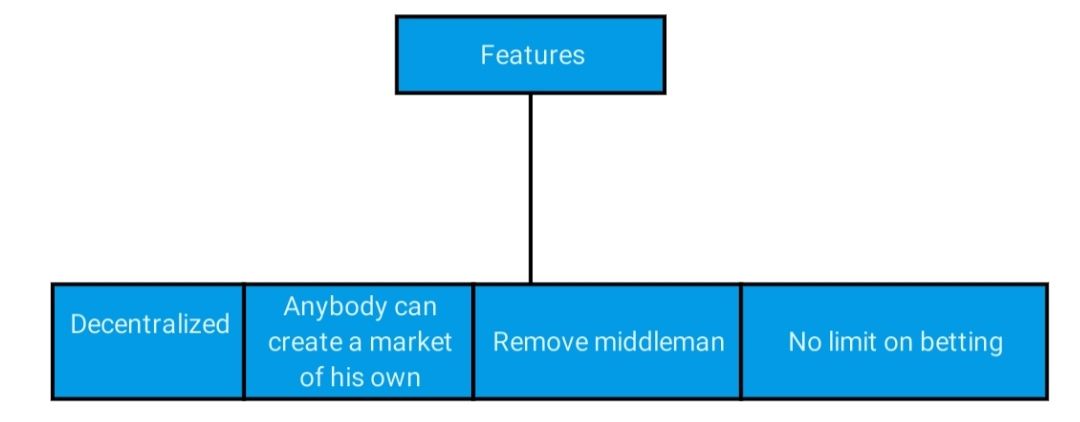

Features

Augur is one of the most successful crypto gambling platforms and has mass appeal. Using Augur anyone in the world can create a market asking about anything. Anybody can purchase and sell shares on the outcomes of the event. DeFi gave the pump to Augur. There is likely more scope to grow. There is no limit on betting. While there are a lot of restrictions on online gambling, Augur has the potential to revolutionize the betting experience.

Augur is among those few Ethereum- based tokens available on Coinbase. REP is its native cryptocurrency. Cryptocurrencies are valuable to the world especially to remove middlemen. Augur could be an example of it. A group of people speculating upon a variety of events. People can bet on the possible outcomes of future events like outcomes of games, election results, etc. The one who wins gets money and those who lose suffer the loss of money. Centralized platforms do not allow global participation. They need traders to trust the market operator to not steal funds. Augur solves these risks and limitations.

How does Augur work?

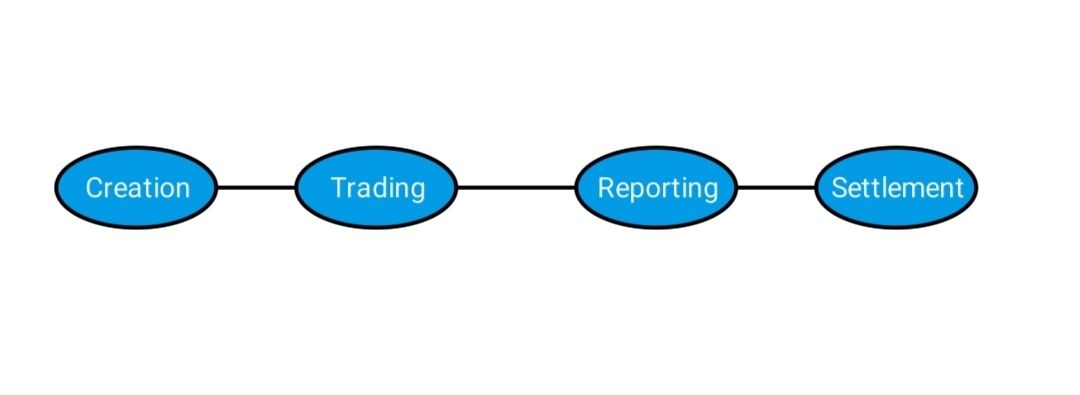

On Augur, one likely to predict what is going to happen. Augur market follows a four-stage progression- creation, trading, reporting and settlement.

Market creator sets an event that participants are going to speculate the outcome. The designated reporter to report the outcome of the event. The market creator also chooses a resolution source which is where the reporter should get the information to determine the outcome. For example if somebody wants to speculate the outcome of a cricket match, his resolution source could be any live broadcaster like ESPN, Sony. The designated reporter can use ESPN.com to verify the outcome of the event market and report it to the one who built the contract. Next step is Trading. It allows the participants to trade shares which represent the probability that a future outcome will happen. It gives shares of contract to the event creators who can trade these shares with anybody at any time until the event is live. Reporting is where a participant verifies the outcome of the event so that contract works accordingly. These reporters are awarded with REP token if they respond honestly and lose token if not. They are financially incentivised through REP tokens to act genuinely. Market settlement is in which traders can close their positions and receive funds.

How does the incentive system work in Augur?

It is important to keep a check on bets and that they are properly categorized. The Incentive system is structured in a way where presumably acting in accordance with consensus or with the rest of the REP holders that coexist with you are the two options. If somebody is not reporting with consensus (which presumably what reality actually reflects) it is not going to be economically profitable to do so. If somebody comes in and tries to perpetuate a reality that does not exist in the real world, all the other REP holders have the financial incentive to come in and correct you and if they end up winning that dispute you lose all REP. This is how the dispute system works back and forth. If you believe that the initial report of the market is incorrect you can take some REP and claim disapproval by staking on that. This gives time to somebody else to come in and give the opportunity to stake against you. These bonds keep escalating till fork happens.

V2 Genesis

Augur initially started as a project based on Bitcoin that eventually grew out as an Ethereum-based protocol pertaining to the ever-growing popularity of Ethereum network in late 2015. Augur was launched with Ether as a trading currency. All the bets were placed in Eth. V2 makes the market creation easier with simple logins by connecting Ledger or Metamask. The first version of the application was relatively slow and slightly expensive. Augur V2 oracles bring off-chain data on-chain. V2 provides a special feature known as ‘invalid wager’. Users can select ‘invalid’ as an outcome meaning that their bet will likely end up being invalid. Another feature that makes V2 superior to V1 is the settlement period. Markets in the first iteration of Augur required seven days to close. According to Tom Kyser, director of Operations at Augur, the settlement time has now been increased up to 72 hours assuming a market is not contested. Augur Version 2 cut trading fees and improved the overall experience of the user.

Process and meaning of Fork in Augur

A fork is the most disputed enough state of the market. Every market on Augur exists in separate versions called Universe. The Universe is created for each possible outcome whenever there is a fork. Each of these markets is referred to as forking market. It has implications for other markets as well that currently exist but do not participate in the forking process. At the fork, no new market can be created and the reporting process pauses. Remember, REP is not necessary in order to trade in Augur but it is important for reporting. The fork continues for 60 days. The traders may have to select an outcome within these 60 days. REP will be frozen in case a trader fails to put a bet on any of the outcomes at the fork.

Augur has been able to built a platform to bet on internet securely. In October it was able to generate more than a million dollar on its betting platform in the wake of the U.S. Presidential elections. This shows the growing acceptance of Augur by the crypto- community.

________________________________________________________Disclaimer: The information contained on this web page does NOT constitute financial advice or a solicitation to buy or sell any cryptocurrency contract or securities of any type. Trading is a high-risk activity. Readers are suggested to conduct their own research, review, analyze and verify the content before relying on them.

To publish press releases, project updates and guest posts with us, please email at contact@etherworld.co.

You've something to share with the blockchain community, join us on Discord!

Follow us at Twitter, Facebook, LinkedIn, Medium and Instagram.