India Intensifies Crypto Oversight as ED Freezes ₹4,190 Cr & 44,057 Tax Notices Sent

India intensifies crypto oversight as ED freezes ₹4,190 crore, CBDT issues 44,057 notices, & three exchanges face major TDS action across FY 2022–25.

India has released one of its most detailed updates yet on enforcement actions in the crypto sector. New disclosures from the Ministry of Finance show that investigative agencies, tax authorities & compliance teams have significantly intensified monitoring of both platforms and individual traders.

The data covers seizures, arrests, tax demands, search operations & TDS compliance checks across multiple financial years. Together, the findings show a coordinated push to bring all crypto activity under India’s tax and reporting framework.

- ED’s Crypto Crackdown

- 44,057 Tax Notices to Crypto Traders

- Three Exchanges Flagged for TDS Issues

- Rising TDS Collections

ED’s Crypto Crackdown Reaches ₹4,190 Crore

India has released one of its most detailed enforcement updates for the crypto sector. According to the Ministry of Finance:

- ₹4,190 crore worth of assets frozen

- 29 individuals arrested

- 22 chargesheets filed

The Enforcement Directorate reports that most cases involve routing illicit money through digital assets, offshore platforms or unregistered intermediaries. Investigators said crypto rails were frequently used to obscure financial trails, prompting freezing orders to prevent further dissipation of funds.

The ministry noted that ED actions span scams, online fraud networks, illegal forex operations & cross-border laundering schemes involving virtual digital assets.

44,057 Income Tax Notices Sent to Crypto Traders

The Central Board of Direct Taxes has intensified scrutiny of individual traders. It confirmed sending 44,057 notices to users who did not report their crypto activity in income tax returns.

The notices follow updated policies for Virtual Digital Assets which include a 30 percent tax on gains and a mandatory one percent TDS on trades. Authorities matched data from exchanges with ITR filings to flag cases where trading volumes or income declarations did not align.

Officials expect additional notices as reconciliation systems improve.

Three Crypto Exchanges Flagged for TDS Non-Compliance

The ministry also reported action against three crypto exchanges that did not meet TDS obligations. The findings include:

- ₹39.8 crore in TDS non-compliance

- ₹125.79 crore in undisclosed income

- ₹888.82 crore recovered through search and seizure operations

Exchanges are required to deduct one percent TDS on every crypto trade involving Indian users. Authorities discovered cases of non-deduction and incomplete reporting, which triggered enforcement action and revenue recovery.

TDS Collections From Crypto Exchanges Continue Rising

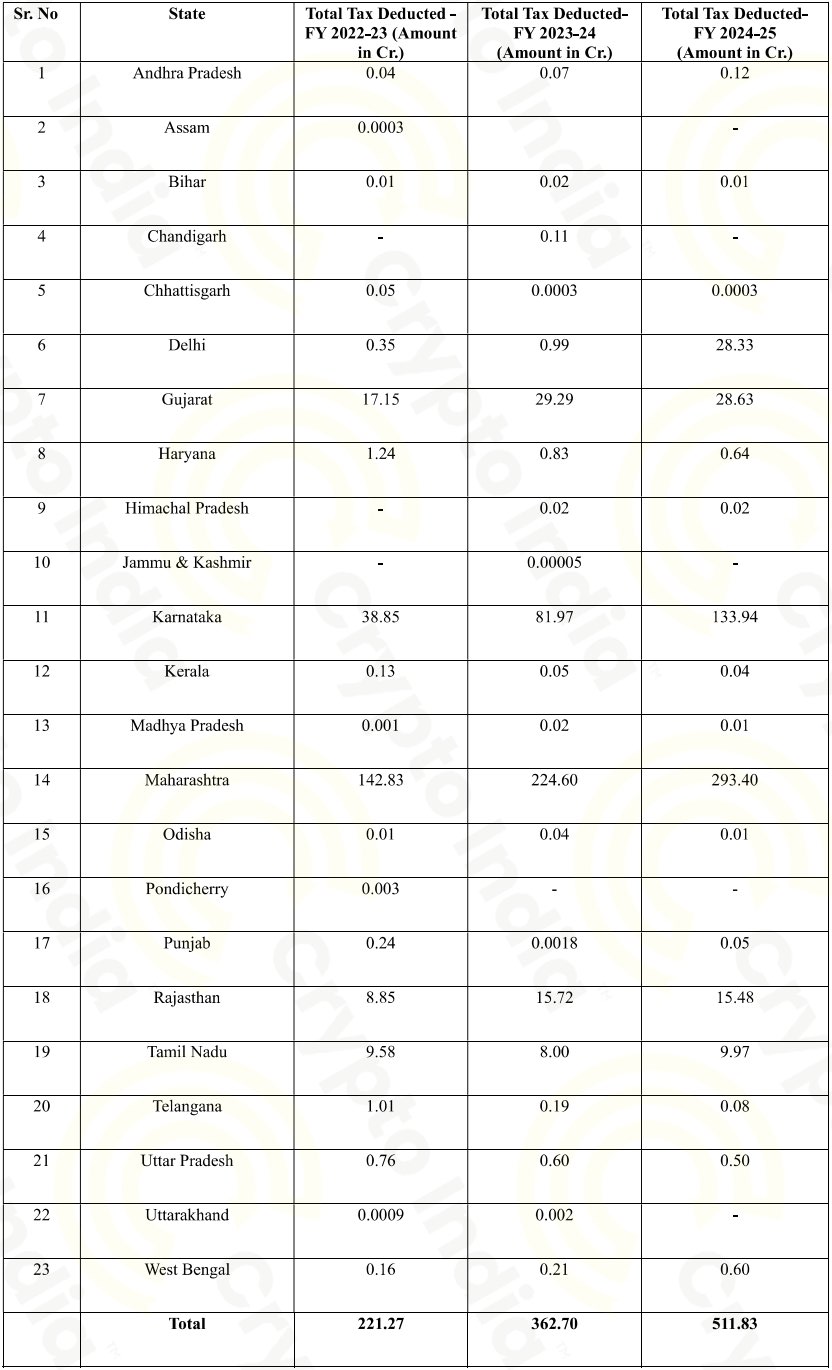

Government data shows steady growth in TDS collections from exchanges:

- ₹511.83 crore in FY 2024–25

- ₹362.70 crore in FY 2023–24

- ₹221.27 crore in FY 2022–23

Officials say the rise reflects improving compliance systems on platforms and stronger oversight by tax authorities. The latest disclosures highlight India’s coordinated enforcement posture.

With global reporting frameworks such as CARF approaching implementation, India appears to be positioning itself for a more structured and transparent digital asset ecosystem. For traders and exchanges, the message is clear. Activity must be fully aligned with tax rules & financial reporting standards.

If you find any issues in this blog or notice any missing information, please feel free to reach out at yash@etherworld.co for clarifications or updates.

Related Articles

Disclaimer: The information contained in this website is for general informational purposes only. The content provided on this website, including articles, blog posts, opinions, & analysis related to blockchain technology & cryptocurrencies, is not intended as financial or investment advice. The website & its content should not be relied upon for making financial decisions. Read full disclaimer & privacy policy.

For Press Releases, project updates & guest posts publishing with us, email contact@etherworld.co.

Subscribe to EtherWorld YouTube channel for ELI5 content.

Share if you like the content. Donate at avarch.eth.

You've something to share with the blockchain community, join us on Discord!