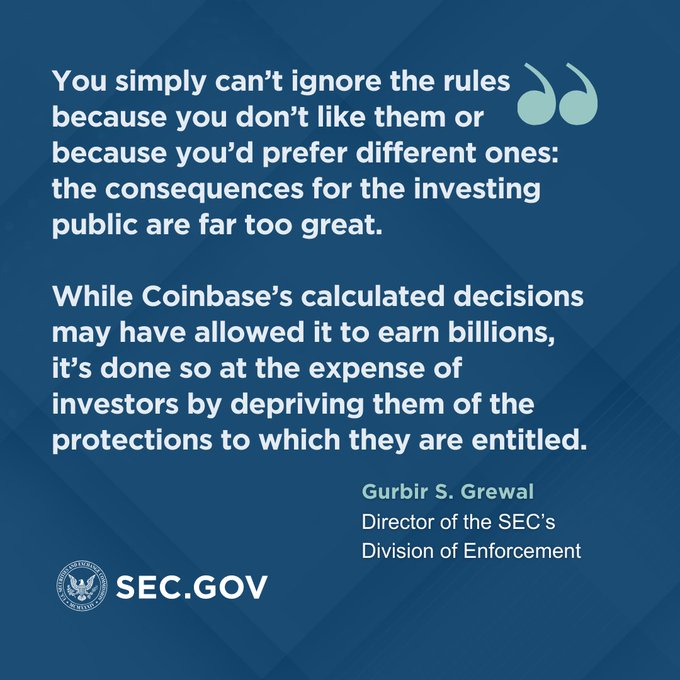

A seismic wave has rippled through the cryptocurrency industry as two prominent players, Coinbase, Inc. and Binance Holdings Ltd., now face significant charges from the Securities and Exchange Commission (SEC). In a groundbreaking move, the SEC has accused Coinbase of operating its crypto asset trading platform without the necessary registration as a national securities exchange, broker, and clearing agency.

In addition to the above, Coinbase is also facing charges for failing to register the offer and sale of its highly popular crypto asset staking-as-a-service program. Simultaneously, Binance, the world's largest crypto asset trading platform, and its U.S.-based affiliate, BAM Trading Services Inc., have found themselves in the SEC's crosshairs, as both entities and their founder, Changpeng Zhao, are accused of multiple securities law violations.

The SEC alleges that Coinbase has been involved in an unregistered securities offering through its staking-as-a-service program since 2019. This program enables customers to earn profits from the "proof of stake" mechanisms employed by specific blockchains. Coinbase pools customers' stakeable crypto assets, validates blockchain transactions, and distributes a portion of the rewards to customers. However, Coinbase failed to fulfill the legal requirement of registering this offering.

Over a month ago, Coinbase filed a lawsuit against SEC regarding the absence of formalized decision-making processes by the SEC, which has led to significant uncertainty for crypto companies. This lack of clarity has hindered their ability to adequately prepare for the future.

As of a few hours ago, SEC filed complaints against Coinbase in the U.S. District Court for the Southern District of New York, alleging violations of registration provisions under the Securities Exchange Act of 1934 and the Securities Act of 1933. The SEC is pursuing a range of remedies, including injunctive relief, disgorgement of ill-gotten gains, penalties, and other forms of equitable relief in response to Coinbase's violation of law of securities.

On a similar note for the other crypto giant, Binance, the Securities and Exchange Commission (SEC) has made allegations that Binance.com and Binance.US, under the control of Zhao since at least July 2017, operated as exchanges, brokers, dealers, and clearing agencies. It is claimed that these entities generated revenue of at least $11.6 billion, primarily from transaction fees charged to U.S. customers. According to the SEC's complaint, the allegations are as follows:

- Binance.com should have registered as an exchange, broker-dealer, and clearing agency.

- Binance.US and BAM Trading should have registered as an exchange and clearing agencies.

- BAM Trading should have registered as a broker-dealer.

The SEC further alleges that Zhao, as a control person, is liable for the registration violations committed by Binance and BAM Trading.

A recent tweet from Binance CEO Changpeng Zhao seems like a response to SEC's action

If you have to pick a fight with everyone, maybe you are the one at fault. 🤷♂️

— CZ 🔶 Binance (@cz_binance) June 6, 2023

A few weeks ago, SEC accused Kraken of violating securities laws by neglecting to register the offering and sale of its "crypto asset staking-as-a-service program." In order to resolve the charges, Kraken has agreed to pay a fine of $30 million and has committed to promptly discontinuing the offering or sale of securities through crypto asset staking services or staking programs.

Related Articles

- Coinbase launched Coinbase International Exchange

- SEC investigating the collapse of Silicon Valley Bank

- Coinbase sues SEC

- SEC enforces full disclosure & investor protection rule on staking-as-a-service

- National Australia Bank to launch Stablecoin on Ethereum

Related Videos

- Australians Lose $3B, SEC vs Bittrex, Aave on zkSync, & More- #WEB3Today #27

- Coinbase Legal Battle, MakerDAO Spark, Bittrex Bankruptcy & More - #WEB3Today #38

- MetaMask x PayPal, Blockchain in China, Fed Now & More - #WEB3Today #40

- Nigerian National Blockchain Policy, Binance Faces US Probe & More - #WEB3Today #35

- PUBG creator to Launch NFT Metaverse Game, Coinbase in Bermuda & more - #WEB3Today #30

Disclaimer: The information contained in this website is for general informational purposes only. The content provided on this website, including articles, blog posts, opinions, and analysis related to blockchain technology and cryptocurrencies, is not intended as financial or investment advice. The website and its content should not be relied upon for making financial decisions. Read full disclaimer and privacy Policy.

For Press Releases, project updates and guest posts publishing with us, email to contact@etherworld.co.

Subscribe to EtherWorld YouTube channel for ELI5 content.

Share if you like the content. Donate at avarch.eth or Gitcoin

You've something to share with the blockchain community, join us on Discord!