The OP token may soon play a more direct role in the economics of the Superchain. A new governance proposal from the Optimism Foundation aims to link OP more closely with real network activity by introducing a structured token buyback program funded by Superchain revenue.

While the proposal makes no claims about price direction, it signals a shift in how OP could interact with market dynamics, treasury flows, and long-term ecosystem incentives. For OP holders, the change is less about short-term speculation and more about how value may increasingly track Superchain adoption over time.

- How the Buyback Mechanism Works

- What This Could Mean for OP Market Dynamics

- Incentive Alignment Across the Ecosystem

- What Comes Next?

Historically, OP has functioned primarily as a governance token, with limited direct linkage to how much the Superchain is actually used. That disconnect is what this proposal is designed to address.

The Superchain, built on the OP Stack, now processes roughly 13 percent of all blockchain transactions and controls over 61 percent of the Layer 2 fee market.

Major networks such as Base, World Chain, Soneium, Zora, Unichain, Ink, Celo, and others contribute sequencer revenue back to Optimism. Over the past twelve months, this model generated 5,868 ETH in revenue.

Until now, all of that ETH flowed into a governance controlled treasury without directly interacting with OP’s market supply. The new proposal changes that relationship.

How the Buyback Mechanism Works

If approved, 50 percent of incoming Superchain revenue will be used to buy OP tokens on a monthly basis for an initial period of one year. These tokens would return to the treasury, where governance retains full control over their eventual use.

For OP holders, several mechanics are worth noting:

- Tokens acquired are not immediately burned

- Future options include burning, staking rewards, or other protocol aligned distributions

- Buyback parameters remain adjustable via governance

The remaining 50 percent of revenue stays with the Foundation to fund operations, infrastructure scaling, and Superchain expansion.

Happy new year everyone! In November last year, I wrote about the changes we were making to refocus the team on what comes next for crypto.

— Optimist Prime (@jinglejamOP) January 8, 2026

Today, the @Optimism Foundation is proposing a token buyback. The goal is to unify the broader ecosystem outside of just our internal…

What This Could Mean for OP Market Dynamics

The proposal avoids explicit price promises, but it introduces several structural changes that OP holders may want to watch closely.

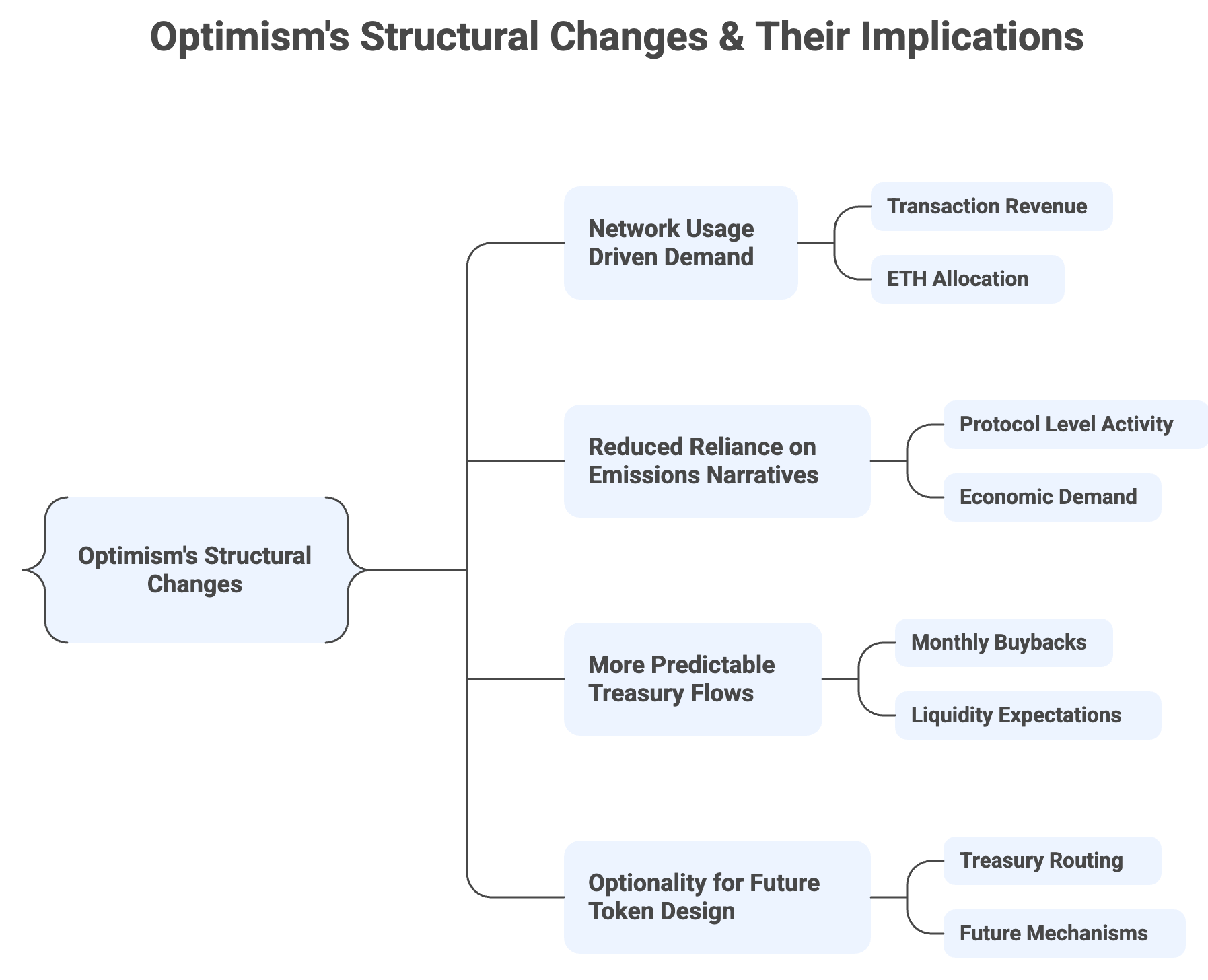

- Network usage driven demand: Every transaction across the Superchain increases the revenue base. As usage grows, the amount of ETH allocated to OP buybacks scales naturally with it.

- Reduced reliance on emissions narratives: Rather than value being driven mainly by governance relevance or future utility promises, OP demand could increasingly come from protocol level economic activity.

- More predictable treasury flows: Monthly buybacks introduce a rhythm to treasury interactions with OP, which could affect liquidity expectations and long-term supply planning.

- Optionality for future token design: By routing tokens back into treasury instead of destroying them immediately, Optimism preserves flexibility for future mechanisms such as staking, shared security, or sequencer coordination.

Incentive Alignment Across the Ecosystem

The Superchain operates on a flywheel model where usage generates revenue, revenue funds development, and development attracts more usage. By routing a portion of that revenue into OP buybacks, tokenholders become more directly tied to the same loop that developers, infrastructure providers, and partner chains rely on.

In practical terms, OP becomes a shared reference asset across the ecosystem, reflecting aggregate Superchain activity rather than isolated governance decisions.

A proposal for the next chapter of Optimism 🔴

— Optimism (@Optimism) January 8, 2026

The Optimism Foundation is putting forward a proposal to align the OP token with growing Superchain demand by directing 50% of incoming Superchain revenue to regular OP buybacks https://t.co/VSDazlbRdX pic.twitter.com/jBQoJyxDCF

What Comes Next?

The proposal is scheduled to move to a governance vote on January 22, with buybacks expected to begin in February if approved. While this is framed as a first step, the Foundation has positioned it as part of a broader roadmap for 2026, suggesting that OP’s role could continue to evolve alongside Superchain decentralization, shared infrastructure security, and protocol governance.

For OP holders, the key takeaway is not immediate price impact but a clearer line between network growth and token relevance, something OP has historically lacked.

If you find any issues in this blog or notice any missing information, please feel free to reach out at yash@etherworld.co for clarifications or updates.

Related Articles

Disclaimer: The information contained in this website is for general informational purposes only. The content provided on this website, including articles, blog posts, opinions, & analysis related to blockchain technology & cryptocurrencies, is not intended as financial or investment advice. The website & its content should not be relied upon for making financial decisions. Read full disclaimer & privacy policy.

For Press Releases, project updates & guest posts publishing with us, email contact@etherworld.co.

Subscribe to EtherWorld YouTube channel for ELI5 content.

Share if you like the content. Donate at avarch.eth.

You've something to share with the blockchain community, join us on Discord!